All Categories

Featured

Table of Contents

Some trading systems bill costs on deals, such as moving funds and withdrawing cash. These costs can vary, depending upon the size of the deal and total trading volume. You might finish up paying a steep rate to access your properties when you need them one of the most. Despite their deceptive name, stablecoins provide no warranty of security versus declining.

Value in cryptocurrencies and other online assets might be propped up by automated trading. Crawlers could be programmed to spot when another investor is trying to make an acquisition, and get prior to the trader can complete their purchase. This method can rise the cost of the digital asset and price you even more to buy it.

Their financial interests may contrast with yours for example, if they acquire and sell to enhance themselves and impoverish you. Furthermore, some large financiers receive positive therapy, such as exclusive cash-outs that are unseen to the public.: There are no government managed exchanges, like the New York Stock Exchange or Nasdaq, for virtual money.

Blockchain Use Cases Beyond Cryptocurrency

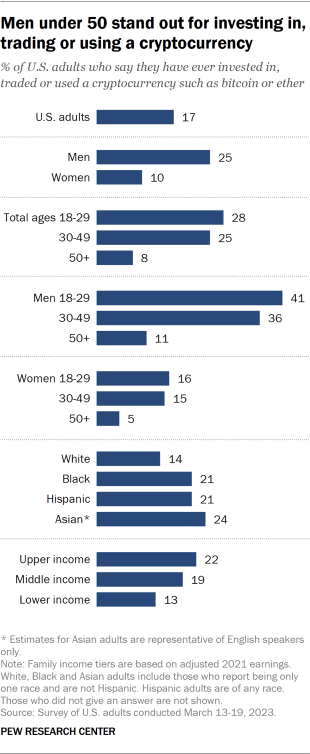

CHICAGO, July 22, 2021 Thirteen percent of Americans evaluated report getting or trading cryptocurrencies in the previous year, according to a new survey carried out by NORC at the University of Chicago. This number is a little even more than half of that of study participants that reported trading stocks (24 percent) over the same duration.

Two-fifths of crypto investors are not white (44 percent), and 41 percent are ladies. Over one-third (35 percent) have home revenues under $60k yearly. "Cryptocurrencies are opening up investing possibilities for more diverse capitalists, which is a great point," claims Angela Fontes, a vice president in the Economics, Justice, and Culture division at NORC at the College of Chicago.

The Future Of Decentralized Autonomous Organizations (Daos)

Various other U.S. regulatory authorities that could have jurisdiction over crypto, relying on the certain usage, consist of the united state Stocks and Exchange Compensation (SEC), the Internal Income Solution (INTERNAL REVENUE SERVICE), the Federal Profession Payment (FTC) and the Workplace of the Business Manager of the Currency (OCC), to name a few. Crypto financial investments are dealt with as property by the IRS and taxed accordingly.

NFTs are electronic assets that live as code on a blockchainoften, yet not exclusively, on the ethereum blockchain. When you purchase an NFT, you acquire ownership of that certain little bit of alphanumeric code, associated with whatever has been tokenized.

Furthermore, when that token is transferred to a buyer, possession of that job is also transferred. This doesn't mean, nonetheless, that an NFT proprietor particularly acquires the copyright to the possession. NFTs may also be accompanied by a "clever agreement," which places conditions on a token-holder's legal rights. The payment of royalties to the original NFT maker could be part of a wise agreement.

This consists of debate over whether an NFT is a security. A coin or token offering is a way for developers of a digital money to elevate cash. Offerings are available in different layouts and could be supplied openly, independently or both. Right here are some instances: In an ICO, a company uses electronic symbols to buy directly to financiers to money a certain job or platform and disperses the symbols through a blockchain network.

Best Practices For Crypto Security In 2024

An STO is comparable to an ICO but should stick to legislations and policies in the country and state where the token is being used. Unlike digital coins or symbols with ICOs and IEOs, security or equity tokens are made use of to elevate resources and represent a stake in an outside possession such as equity, financial debt or an asset such as crude oil.

Ownership of safety symbols is tape-recorded on an immutable blockchain journal. Investors must assess all corresponding info, including the internet site and white paper.

Others will certainly not or will require modifications to attend to factors varying from legal choices and regulatory frameworks to modern technology advances, expenses and customer demand. In the U.S., if a coin or token offering is a safety, or represents itself to be a safety and security, it should be registered with the SEC or qualify for an exception from registration.

Privacy Coins: A Deep Dive Into Their Benefits And Risks

Coin and token offerings beyond the united state could or might not be registered. Regardless of policy standing, scams and cost adjustment can still occur. One more way to gain direct exposure to the electronic property sector is to purchase safety and securities in public business that are associated with relevant monetary innovation, or fintech, industries, or funds made up of such business

Self-awareness is crucial in investing, specifically in crypto. By recognizing the sort of financier that you are, you can pick an investment approach that matches your objectives and take the chance of tolerance. While no archetype is ever before an ideal suit, these capitalist types can help you determine some tools that are specifically useful to you.

The Beginner The Bitcoin Maximalist The HODLer The Trader The FOMOer The Seeker The Typical Financier The Environment Professional The Crypto Native The Early Adopter The Whale Have a look at the description and traits of each investor type and see which one matches you the best. After that, when you've discovered your type, inspect out the devices that similar financiers utilize to make smarter choices.

While the primary step can be the hardest, it's the most important. Luckily, this novice's guide to building a successful crypto portfolio will certainly aid make it as very easy as possible. Attributes of a beginner: Fascinated in crypto however unsure where to start. Wanting to boost their wide range, and their understanding.

Understanding Smart Contracts And Their Applications

Devices that can aid a novice: While the crypto area is building several exciting modern technologies, bitcoin maximalists take into consideration the safe and secure, sound money of bitcoin to be the most vital. Influenced by the brilliance of the blockchain and Satoshi's innovation, they came for the innovation, yet remain for the transformation. Attributes of a bitcoin maximalist: Acquires every dip.

Satoshi is their hero. Devices that can assist a bitcoin maximalist: The HODLer can see the worth of his coins double in a month or dip 30% in a day and never even think of selling. Well, they may consider selling, however they have the discipline to maintain HODLing via the highs and the lows.

Devices that can aid an investor: FOMO is the Concern Of Missing out on Out. It's a psychological state that's all also simple to yield also, particularly as prices increase and develop crypto millionaires over night.

Latest Posts

The Role Of Stablecoins In The Crypto Market

How To Get Started With Cryptocurrency Investing

Cryptocurrency Regulations Around The World